Interview: Stefan Delaet on international AML regulations and cross-border cooperation

AML (Anti-Money Laundering) is a complex challenge that requires international collaboration. We sat down with Stefan Delaet, General Manager Financial Crime at KBC Group, to discuss the impact of geopolitics, regulatory shifts, and AI on AML.

AML (Anti-Money Laundering) is a complex challenge that requires international collaboration. We sat down with Stefan Delaet, General Manager Financial Crime at KBC Group, to discuss the impact of geopolitics, regulatory shifts, and AI on AML.

What do you think about recent articles about the pausing of the Foreign Corrupt Practices Act (FCPA), the disbanding of anti-corruption task forces, and the lack of enforcement around beneficial ownership reporting under the Trump 2.0 administration? How will these developments affect European AML lawmakers?

Since Europe introduced its first AML directive in 1991, it has gradually developed its own regulatory framework. This has resulted in the extensive single rulebook under the AMLR and the establishment of the Anti-Money Laundering Authority (AMLA).

On an international level, I believe the Financial Action Task Force (FATF) now has a much greater impact than the US. In total, over 200 countries and jurisdictions have committed to implementing FATF standards as part of a coordinated global response to prevent organised crime, corruption, and terrorism.

The Trump administration’s current actions reflect an isolationist attitude aimed at protecting America from foreign threats and making America big again by limiting regulatory pressure on US firms and citizens. However, as mentioned, the EU has developed its regulatory framework and will continue to do so to preserve its internal market and its international trade position.

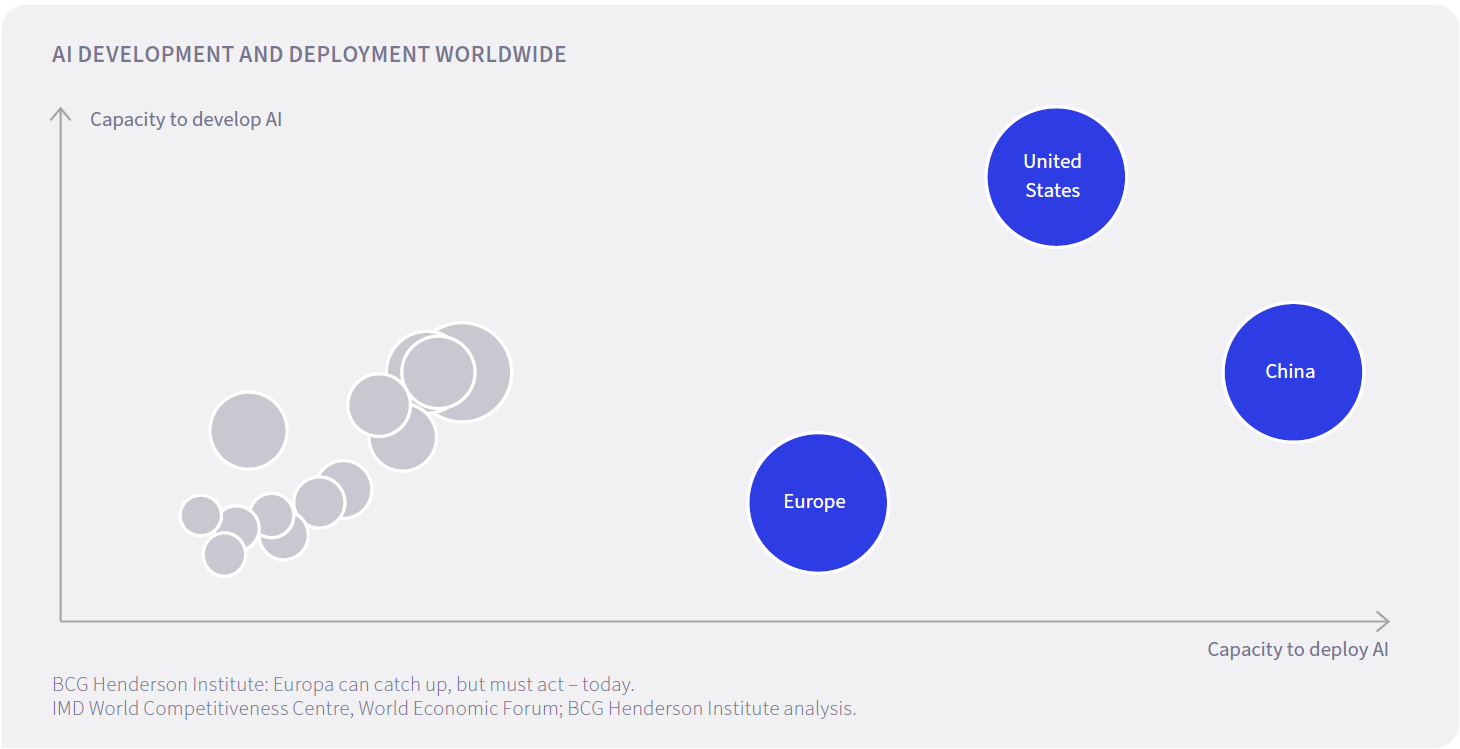

The graph below from BCG Henderson highlights three significant trends: the United States leads in the creation of AI applications, China in their deployment, and the European Union in their regulation. How do you think geopolitics impact AML?

It is interesting, though not surprising, to see how different geographies follow different paths when it comes to embracing technology. Over the past decade, most new technologies have emerged from the ‘land of the free’ (the United States) driven by libertarian capitalism and the innovation engine of Silicon Valley. China, as a state-driven economy, has excelled at rapidly copying and deploying technologies across entire sectors and regions. Although lately, it is increasingly becoming a hub for development. Europe is literally in the middle and tries to make a careful trade-off between technology, politics, and consumer interest.

Europe is actually quite sophisticated and capable – also in tech.

So in the fight against financial crime, what should take priority? Technology, people, or politics?

Well, it’s clear: these three levers need to point in the same direction. Only then can we achieve sustainable change or development and move from a push-driven to a pull-driven market. Some argue that Europe is a political midget that lacks the courage to reduce regulations and therefore hinders the economy and evolution. Personally, I think that, apart from some regulatory exaggeration, Europe is actually quite sophisticated and capable – also in tech. At the same time, Europe is considerate of human rights, which is crucial for a strong democracy.

In other words, I believe that balancing the levers is in everybody’s interest. Even if it sounds like a temporary setback to some people, I believe it’s better than living in a society ruled by technocrats or autocrats. In the fight against money laundering, ‘blacklisting’ of countries has long been a key tool. However, it’s not the only one, and it can quickly become a political tool in current geopolitical times. Criminals are becoming more professional and tech-savvy, as they run their traffic through low-risk countries.

That means we cannot relax our rules or our investments in technology if we want to be effective in anti-money laundering and counter-terrorist financing.

Stefan Delaet is General Manager Financial Crime at KBC Group, with over 20 years of experience in leadership roles across strategy, finance, and risk. With his strong legal background, he brings a rigorous and principled approach to regulatory compliance and the fight against financial crime. His mission? To ensure that KBC remains resilient and ready for the future.