The advantages of Data Science as a Service for AI-based transaction monitoring

Artificial intelligence is a powerful tool in the world of transaction monitoring. But what’s the best way to implement it? Your financial institution (FI) could bring in a team of data scientists and engineers to build a brand-new solution, but it might risk blowing the budget. A myriad of off-the-shelf solutions are available, but ‘click-and-drag’ components are limited when it comes to customisation, and frameworks require time and expertise to be transformed into functional solutions. That’s why it’s worth considering the new option in town: Data Science as a Service (DSaaS) models.

DSaaS models are subscription-based services that give FIs access to complete AI-based transaction-monitoring solutions. Read on to discover the advantages of DSaaS models and how they compare to other solutions.

Artificial intelligence is a powerful tool in the world of transaction monitoring. But what’s the best way to implement it? Your financial institution (FI) could bring in a team of data scientists and engineers to build a brand-new solution, but it might risk blowing the budget. A myriad of off-the-shelf solutions are available, but ‘click-and-drag’ components are limited when it comes to customisation, and frameworks require time and expertise to be transformed into functional solutions. That’s why it’s worth considering the new option in town: Data Science as a Service (DSaaS) models.

DSaaS models are subscription-based services that give FIs access to complete AI-based transaction-monitoring solutions. Read on to discover the advantages of DSaaS models and how they compare to other solutions.

Skip the messy development process

Building a new product from scratch is a big job. It requires a lot of research and experimentation, and people often underestimate how long this will take. When an approach or strategy doesn’t work out, you have to go back and start again. And again. And again. Until you finally create the perfect formula for delivering the solution. It’s a time-consuming process, the length of which can’t always be predicted.

With a DSaaS model, there’s no need for trial and error, or a crystal ball. Your FI receives a solution that arrives complete and ready for action; a solution the original developers have already put to the test. This means you reap the benefits while avoiding the trials and expensive mistakes it takes to develop a product from scratch.

‘The hard (and arguably less fun) part of developing AI models is the journey from a first proof of principle to a mature solution. Accounting for around 20% of the development, this stage is infamous for taking 80% of the time. It involves pushing performance to the limit, monitoring data quality and model behaviours, allocating capacity for the frequent retraining of models, and more. From my experience as data scientist, this is a job I’d rather leave to a DSaaS provider, whilst focusing myself on the less regulatory scrutinized work.’

Customised by experts to suit your FI

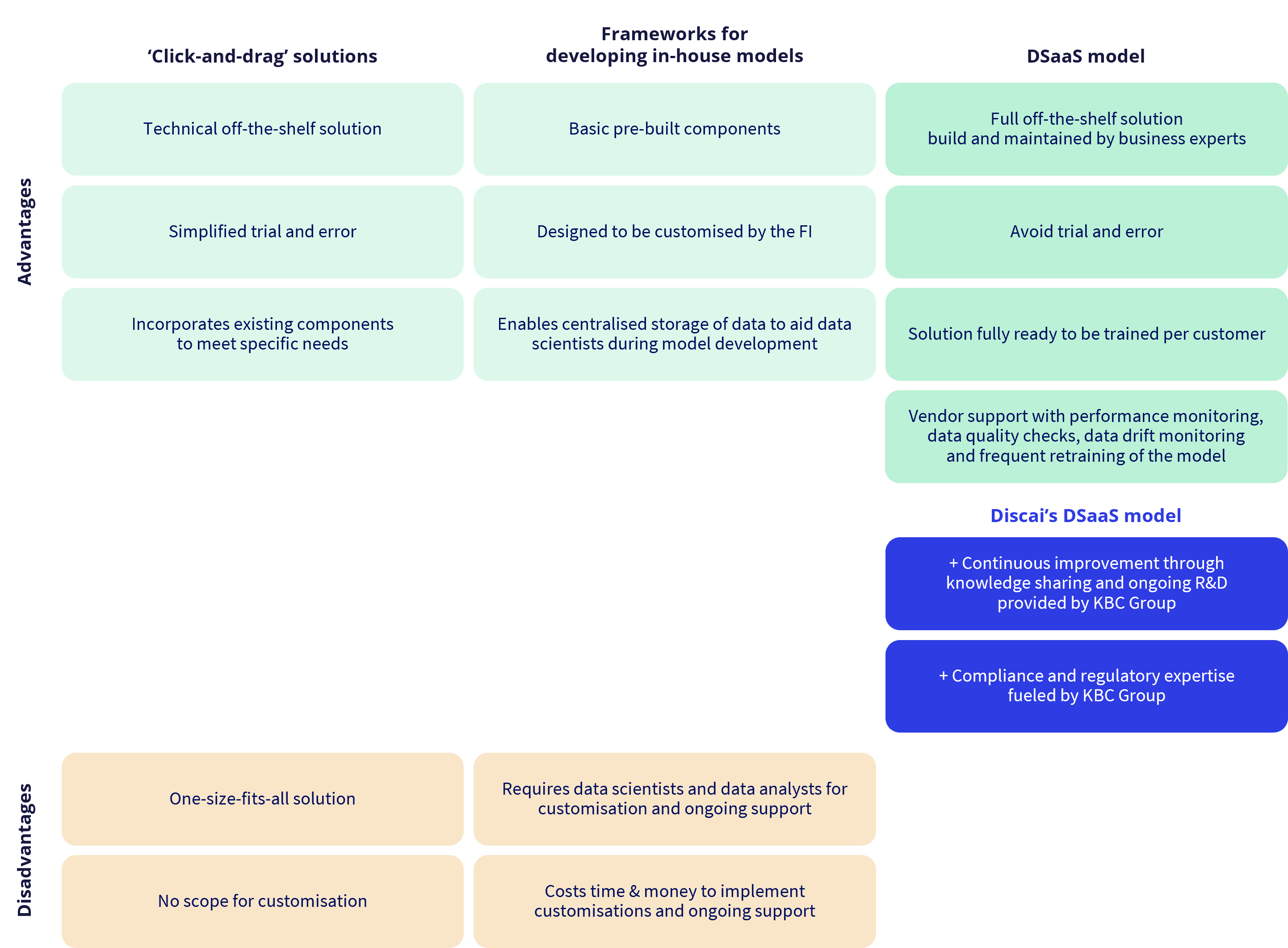

There are two traditional types of off-the-shelf solutions for transaction monitoring:

- ‘click-and-drag’ solutions; and

- frameworks that enable the efficient development of in-house models

‘Click-and-drag’ solutions allow you to incorporate existing components to meet specific needs. These are a great way to avoid the pain of trial and error, but it’s important to remember they’re one-size-fits-all solutions. This means they rarely fit perfectly within the context of your particular FI, and might not have the scope to deal with specific customer demographics or specific dashboard requirements, for example. Frameworks for developing in-house models, on the other hand, do enable tailored solutions. The downside is that you also need to employ data-savvy people to implement the customisations, which takes time and money.

A DSaaS model offers the benefits of both these approaches—and negates their main disadvantages. It’s an off-the-shelf solution, but you don’t need to employ a team of data scientists and engineers to customise it. Solution tailoring happens at the source; the DSaaS vendor’s data experts and systems integrators finetune the model and its interfaces to suit your requirements. And there’s no better team for the job. These are the experts who have not only developed the DSaaS model, but have customised the solution many times before, for many different situations. They know the model’s architecture inside out, and can design the best set-up for your FI.

Next-level performance monitoring

Working with a DSaaS provider offers more opportunities than simply access to its solution. Since it has repeatedly developed and deployed the system in various FIs of different sizes, geographies and customer demographics, a DSaaS provider can produce a confident view on the performance of your FI’s transaction monitoring versus that of other FIs. This means it can deliver unique insights when it comes to benchmarking.

On top of this, a DSaaS provider can offer educated advice regarding how much your FI’s transaction-screening performance is likely to improve due to actions taken in the area of data, such as the addition of new fields or new datasets, or the mitigation of potential data-quality issues specific to the use of artificial intelligence.

Knowledge sharing enables continuous improvement

When AI-based transaction-monitoring solutions are developed in silos, there’s no accessible flow of (non-sensitive) information. But with a DSaaS model, a stream of insight connects the solutions in place at different FIs. Knowledge is able to flow from one party to the next, meaning customisations and improvements made to a model at one FI can be implemented at others. Beneficial changes or new components can be released to all parties that are using the same DSaaS model. This creates a cycle of continuous improvement that is simply not possible with individual transaction-monitoring solutions.

Find out if a DSaaS model is right for your FI

To cope with the digital age, anti-money laundering measures have evolved in leaps and bounds. This has led to a huge wave of innovation in approaches to transaction monitoring, and opened the door to a (sometimes overwhelming) number of vendors and solutions. It’s definitely worth exploring DSaaS models because they might well be the ideal solution for your situation. They’re easy to implement like other off-the-shelf solutions, but they come with the added benefits of expert customisation and ongoing support and improvement.

Ready for a transaction-monitoring upgrade? Contact Discai. We’ll discuss the options with you and introduce you to our own DSaaS model, which has already proven its value in FIs of varying sizes, across a wide number of geographies and customer demographics. Developed by a team of data scientists and data engineers over several years, our DSaaS model is supported by extensive domain expertise and ready to be finetuned by our experts to suit the specific needs of your FI.

Need a pre-built AI-based solution for transaction monitoring? Data Science as a Service might be the answer.

Discover the benefits of DSaaS models