Understanding today’s challenges in anti-money laundering

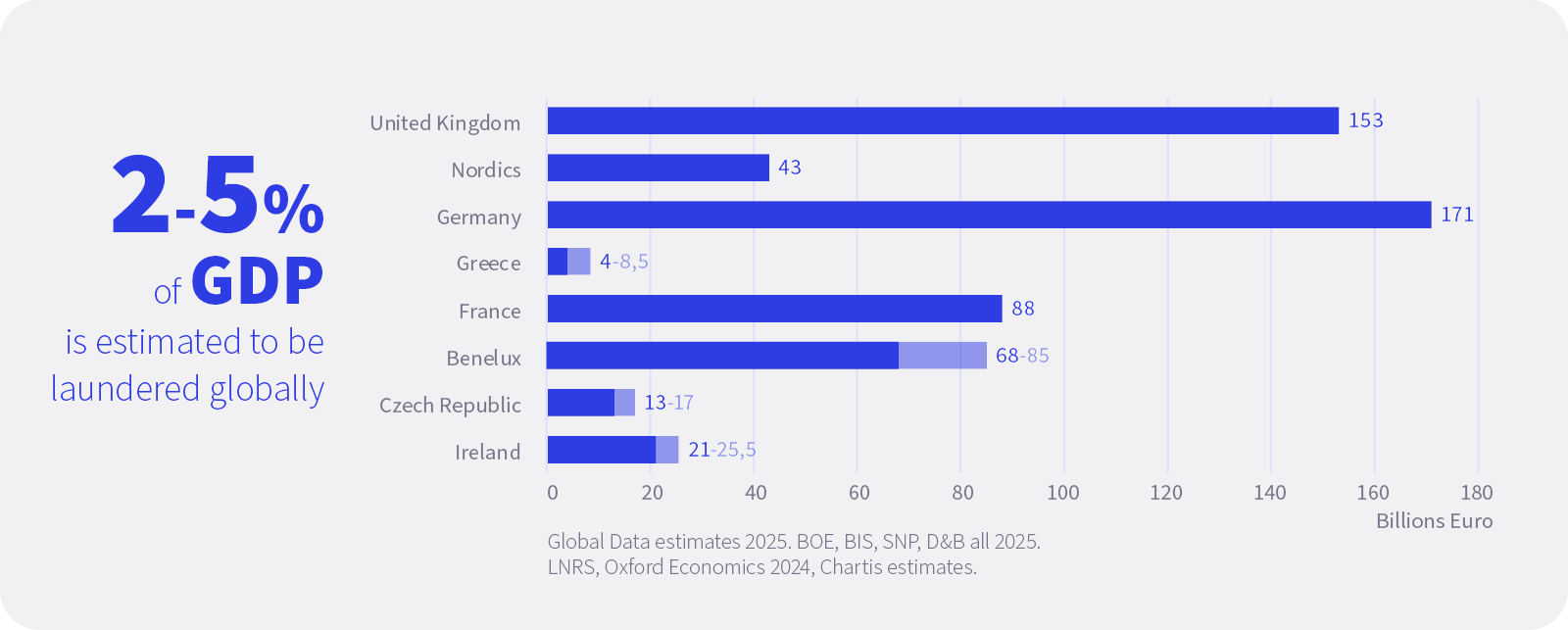

Financial institutions face mounting pressure in the fight against money laundering: from increasingly sophisticated criminal tactics and growing regulatory oversight to talent shortages, legacy systems, and fragmented data.

Criminals exploit globalisation, digitalisation, and innovation to evade detection, making money laundering harder than ever to uncover. While AI introduces powerful capabilities, understanding the key issues facing AML today is crucial before moving forward.

Financial institutions face mounting pressure in the fight against money laundering: from increasingly sophisticated criminal tactics and growing regulatory oversight to talent shortages, legacy systems, and fragmented data.

Criminals exploit globalisation, digitalisation, and innovation to evade detection, making money laundering harder than ever to uncover. While AI introduces powerful capabilities, understanding the key issues facing AML today is crucial before moving forward.

How money launderers are adapting

Using complex, international structures

Financial operations are becoming decentralised and multi-layered. Criminal networks exploit geopolitical instability and inconsistent enforcement across jurisdictions to move illicit funds through hard-to-trace pathways. Techniques like trade-based laundering and money mule schemes enable quick, large-scale transfers, complicating detection.

Exploiting digital onboarding

Digitalisation has streamlined remote onboarding, which is a great advantage for customers, but risky for AML. Money launderers increasingly use identity theft, synthetic IDs, and AI-generated deepfakes to bypass controls, impersonate clients, and open fraudulent accounts.

Leveraging instant payments

Faster payment schemes (e.g., SEPA Instant Credit Transfers) speed up legitimate transactions, but also criminal ones. Tactics like smurfing and account takeovers allow illicit funds to move almost instantly, challenging monitoring systems to keep pace.

What is smurfing?

Smurfing (or structuring) is the practice of breaking up large amounts of money into multiple smaller transactions that fall below the reporting threshold, to avoid detection by financial institutions and regulators.

Abusing generative AI

Generative AI empowers criminals to create synthetic identities, deploy AI chatbots for scams, and scale fraud operations. According to Celent, about 20% of fraud cases involved AI-generated elements in 2024, underscoring the dual-edged nature of the technology.

Laundering via crypto and DeFi

Cryptocurrencies and decentralised finance offer anonymity and borderless reach, enabling criminals to shift illicit funds rapidly across jurisdictions, often beyond traditional oversight. The decentralised nature of these systems complicates enforcement and detection.

The complex regulatory landscape

As criminal tactics shift, the regulatory environment must also keep pace. Governments and regulators around the world are responding with increasingly comprehensive AML frameworks, placing greater pressure on financial institutions to keep pace and comply.

The EU AML package and AMLA

The European Union’s AML package introduces harmonised regulations, tighter customer due diligence, enhanced crypto oversight, and a centralised Anti-Money Laundering Authority (AMLA) to supervise high-risk institutions and foster cooperation across member states.

The EU AI Act

This legislation sets a risk-based framework for AI use in all sectors, including AML in financial institutions. Compliance requires managing AI risks, ensuring data quality and fairness, maintaining transparency, and incorporating human oversight.

GDPR and data protection

Handling sensitive customer data must comply with privacy laws like GDPR. Balancing privacy with AML obligations (especially in cross-border data sharing) remains a major pain point, with non-compliance risking heavy fines and reputational damage.

Digital Operational Resilience Act (DORA)

DORA mandates robust ICT risk management, resilience testing, and strict cybersecurity standards for third-party vendors, raising the bar for operational resilience in increasingly digital AML operations.

Escalating enforcement

Regulators are intensifying enforcement, imposing record fines, such as Binance’s $4.3 billion and TD Bank’s $3.1 billion penalties in 2024. These penalties highlight the risks of non-compliance beyond financial loss to reputational and business continuity damage.

Want more background on the shifting market and the landscape of money laundering today? Learn more with these 7 emerging trends in the field. Or curious for strategies for successful AI adoption? See how you can put AI into practice.

Pressure on people: talent and resourcing

Keeping up with rules and regulations requires more than policy – it depends on people. AML success hinges on skilled professionals who can interpret complex regulations, investigate suspicious activity, and collaborate across functions. But as compliance demands rise, institutions are facing critical shortages in the talent and expertise needed to deliver effective AML programs.

- A competitive talent market: AML roles require a rare blend of legal, compliance, and data science expertise. PwC reports over 90% of firms plan to grow AML teams by at least 10%, underscoring a severe shortage. The high-stress nature of AML work can scare candidates off.

- Retaining talent: High workloads, manual false positive reviews, limited feedback, and low conviction rates contribute to job dissatisfaction and turnover. Retention requires investment in career development, automation to reduce repetitive tasks, and building a culture that values AML impact.

- Evolving skillsets: AML roles now demand a combination of regulatory and legal expertise, data and AI fluency, and investigative thinking. Continuous training, simulations, and cross-disciplinary education are essential to keep teams effective.

We asked Stefan Delaet, General Manager Financial Crime at KBC Group, for his perspective on the evolving AML landscape. He agrees with AFC Tech expert Shlomit Wagman that the rise of AI means more skilled AML professionals will be needed – not less:

I believe what she says is valid. Training and development plans should emphasise continuous learning, combining both theoretical knowledge and practical skills. This includes training on the latest AML software and data analysis techniques, as well as keeping up to date with regulatory changes. Upskilling staff through certifications, workshops, and hands-on training is vital to keep up with the evolving AML landscape.

Data management: the backbone of AML, yet a persistent challenge

Even the best-trained professionals can’t succeed without access to clean, connected data. Strong data management is the foundation of effective AML, but many organisations still struggle to get it right. They face fragmented data and inconsistent quality and lack unified views, hindering detection and response.

- Fragmented data and poor quality: Data silos across systems and departments stand in the way of a consistent and complete view needed for monitoring. Missing identifiers, duplicates, and inconsistent naming complicate entity resolution and make it difficult to uncover suspicious networks.

- Lack of dedicated financial crime data platforms: Without centralised platforms bringing together data from internal sources and external watchlists, institutions struggle with inefficient, unreliable processes that limit actionable insights.

- Risks of bias, discrimination, and accountability gaps: AI tools can involuntarily perpetuate bias, disproportionately flagging individuals based on race, nationality, or socioeconomic status. Flawed datasets, outdated models, or operator biases risk regulatory backlash and reputational harm.

- Trust, transparency, and governance hurdles: AI-driven AML demands transparent, auditable models. Without clear governance and explainability, demonstrating compliance and managing risk becomes difficult, complicating relationships with regulators and internal stakeholders.

Sticky legacy systems: a major barrier to effective AML

Beyond data quality, the tools institutions rely on can either support or sabotage AML efforts. Unfortunately, legacy systems remain a persistent drag on agility, effectiveness, and innovation.

Many institutions are still dependent on legacy transaction monitoring tools that stand in the way of AML effectiveness.

- Batch processing and limited visibility: Legacy systems rely on batch-based, ex post processing, limiting real-time risk visibility and holistic portfolio monitoring. This narrow focus undermines comprehensive risk management.

- High false positives and operational strain: Rule-based legacy tools generate excessive false positives, overburdening compliance teams with manual reviews, increasing costs, causing fatigue, and frustrating customers due to unnecessary transaction delays.

- Inability to keep pace with evolving threats: Static thresholds and simple rules fail against advanced laundering techniques. Missing advanced analytics like network analysis, legacy systems keep institutions reactive and vulnerable to fines and reputational damage.

- High maintenance and operational costs: Legacy platforms require costly patches, manual updates, specialised staff, and on-premises infrastructure. Heavy customisations to meet regulatory changes prolong implementation and increase vendor dependency.

- Complex integration challenges: Incompatible architectures complicate integrating real-time monitoring and AI tools, requiring costly middleware and system overhauls. Fragmented IT ecosystems slow innovation and delay adoption of modern AML solutions.

Finding your way in the crowded vendor landscape

As institutions look to modernise, choosing the right technology becomes its own challenge. The AML tech market is flooded with vendors, many marketing traditional tools as “AI-powered” without true machine learning. Variations in efficiency, transparency, and effectiveness make vendor selection complex and frustrating.

From challenge to opportunity

Taken together, these challenges paint a complex picture of today’s AML efforts. But they also create a powerful case for smarter, AI-powered solutions that can reduce burden, boost effectiveness, and strengthen resilience.

Today, advanced AI-driven tools are already used to enhance transaction monitoring, reduce false positives, improve effectiveness, and enable proactive financial crime detection.