10 key trends in money laundering from Belgium’s 2024 FIU report

The annual report of Belgium’s Financial Intelligence Unit reveals a sharp rise in suspicious transactions and emerging money laundering typologies. These findings show why advanced tools like AI and network analysis are essential in tackling the wide spectrum of financial crime.

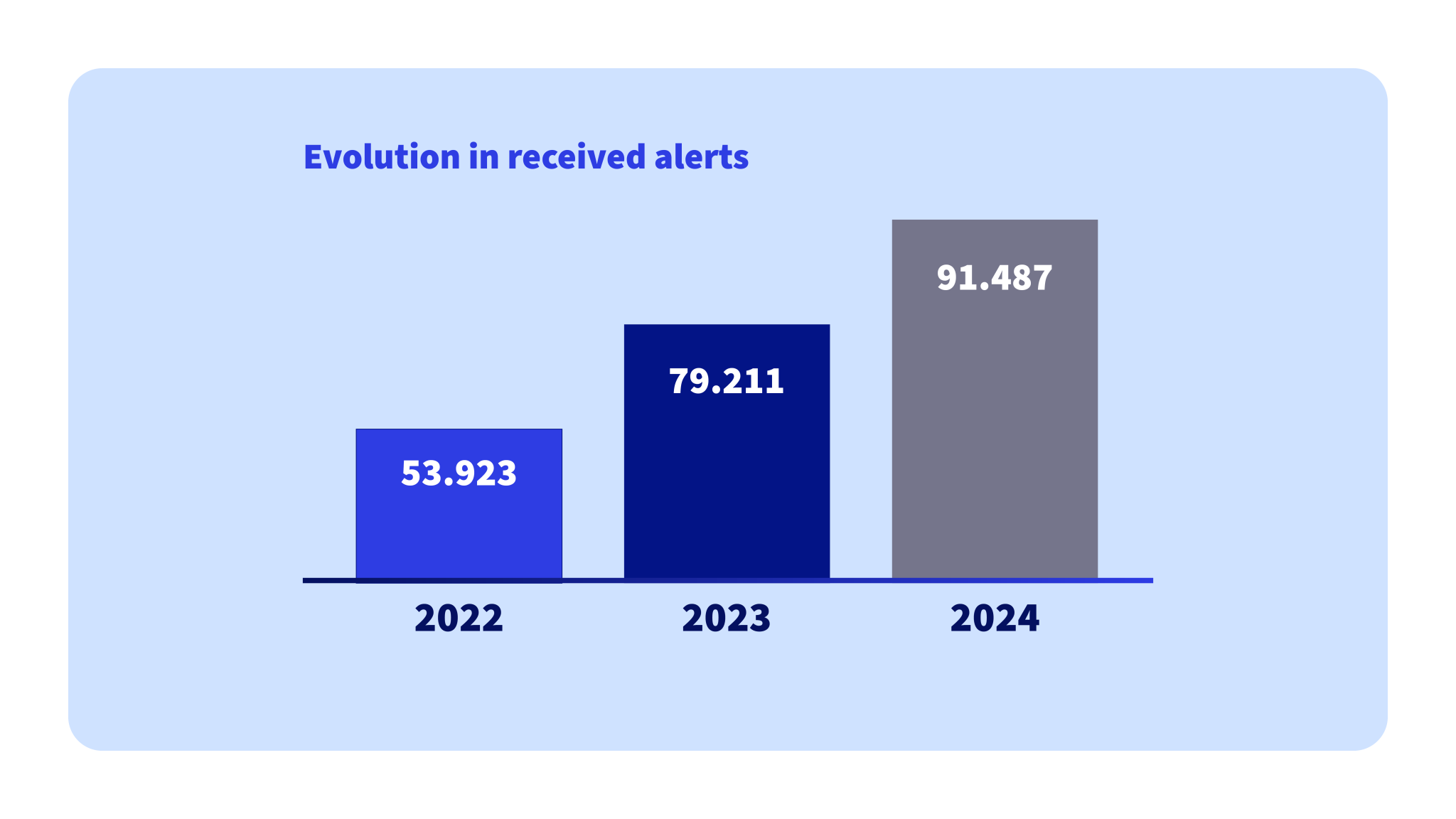

The headlines in the 2024 CTIF-CFI report include a 70% rise in suspicious transaction reports since 2022 and billions in suspicious funds transmitted. The agency also highlights the increasingly complex tactics behind global financial crime, from cryptocurrency and public-sector corruption to human trafficking.

The annual report of Belgium’s Financial Intelligence Unit reveals a sharp rise in suspicious transactions and emerging money laundering typologies. These findings show why advanced tools like AI and network analysis are essential in tackling the wide spectrum of financial crime.

The headlines in the 2024 CTIF-CFI report include a 70% rise in suspicious transaction reports since 2022 and billions in suspicious funds transmitted. The agency also highlights the increasingly complex tactics behind global financial crime, from cryptocurrency and public-sector corruption to human trafficking.

In the fight against money laundering and financial crime, Belgium’s CTIF-CFI is an essential player, analysing and disrupting illicit financial flows across borders. By examining the findings in its latest report, we aim to shed light on the ways criminals exploit the financial system, and how AI-driven solutions can play a vital role in stopping them.

Anti-money laundering in figures

The key findings from the CTIF-CFI annual report show that:

✓ in 2024, CTIF-CFI received nearly 91,500 suspicious transaction reports. That’s a 15% increase from 2023 and almost 70% higher than in 2022;

✓ credit and payment institutions generated 90% of these reports. Most were shared with European counterparts through cross-border reporting;

✓ CTIF-CFI forwarded 1,347 case files to judicial authorities, representing €1.96 billion;

✓ 3,054 reports, including follow-ups, totalled more than €2.3 billion in judicial transmissions.

The role of financial intelligence

As Philippe De Koster, the head of the CTIF-CFI, says in his foreword to the latest report:

“In the world of the fight against financial crime, money laundering and terrorist financing, it is necessary not only to analyse the key numbers, but also — and most importantly — to draw useful lessons from it in order to adapt anti-money laundering strategies, in which the use of financial intelligence plays an essential role.”

10 key trends

Analysing the data collected for its annual report, the CTIF-CFI identified the following 10 trends, from drug trafficking and cryptocurrency to embezzlement by public officials.

1 – Compensation techniques remain dominant

Cash is exchanged between criminal groups outside the formal banking system, making detection difficult and allowing criminals to bypass AML controls.

2 – Traceability is becoming more complicated

The report notes increasing use of shell companies, third-parties such as travel agencies and notaries, and professional laundering networks. Criminals leverage apparently legitimate entities and intermediaries to obscure the origin and destination of illicit funds.

3 – Legal structures provide façade of legitimacy

86% of criminal networks use legal business structures to commit and hide criminal acts with the purpose of laundering money. These structures provide a façade of legitimacy, often exploiting financial and regulatory loopholes to integrate proceeds into the formal economy.

4 – Fraud remains the most common predicate offense

There has been a shift from “mass fraud” to “targeted fraud” and especially investment scams, with higher average financial losses. Criminals use multiple shell companies, payment service providers and crypto transactions to create additional complexity.

5 – Cross-border cooperation is essential

At least 15 cases in 2024 involved corruption or embezzlement by public officials, many with foreign links. This highlights the transnational nature of corruption and the need for stronger cross-border cooperation and asset tracing mechanisms.

6 – Drug trafficking remains financially significant

Profits from drug trafficking are laundered through both “self-laundering” and professional networks. While self-laundering is more traceable, professional networks are adept at severing the link between drug sales and financial flows.

7 – Real estate is a key channel

Property remains an important measure for harbouring money from drug trafficking in Belgium and abroad, while ownership is hidden through complex structures involving friends and family. Real estate is often used to sell or harbour cash-intensive professional activities. International business in exclusive cars and watches has also been identified.

8 – Cryptocurrency is growing in importance

Cryptocurrency’s partial anonymity and insufficient Know Your Customer processes pose growing challenges for enforcement, with a lack of evidence of the origin of funds. In one instance, collaboration led to the blocking of about €4.4 million in crypto assets.

9 – Terrorism financing has three main focus areas

The focus has been on jihadist networks, notably foreign fighters, with financial activity linked to the Israel–Hamas conflict and right-wing extremism also monitored.

10 – CTIF-CFI plays a critical international role

The volume of cross-border reports highlights CTIF-CFI’s role in international information sharing and operational awareness. The agency stresses the value of qualitative reporting, bolstered by new regulatory tools and outreach materials.

4 focus areas for the Belgian FIU

The CTIF-CFI is focusing on four key areas in its efforts to disrupt illegal activity, including greater vigilance at entry points for trafficked drugs and stepping up international cooperation.

Use of facilitators

Mediators such as accountants and notaries may knowingly or unknowingly enable money laundering by setting up opaque structures that shield beneficial ownership.

International cooperation

Enhanced data sharing and joint investigations are critical to tackling cross-border laundering schemes.

Ports & airports

A sharp decrease in the confiscation of cocaine has triggered warnings about the risks at hubs like airports and seaports. These entry points are increasingly exploited for trafficking, with reduced seizures suggesting criminals are employing more sophisticated methods.

Child sexual exploitation

Online child sexual exploitation is likely to increase as AI adoption grows. Efforts to combat the crime in 2024 resulted in around 20 cases, often identified via coded or vague payment references and transfers to high-risk countries.

2024’s key developments in the fight against money laundering

✓ The launch of the goAML reporting tool, aimed at improving reporting efficiency. This platform streamlines the submission and analysis of suspicious activity reports, enhancing responsiveness and data quality.

✓ Publication of a vademecum with typical money laundering examples, and hosting of workshops on AML and combating the financing of terrorism (CFT).

✓ Active contribution to the new EU AML legislative package. CTIF-CFI is aligning national practices with evolving EU standards to strengthen the AML/CFT framework.

✓ Belgium underwent evaluations by the Financial Action Task Force and the OECD on AML and anti-corruption performance. The results will shape policy and regulatory priorities, with a public report expected in October.

Using AI to fight financial crime

The increasing sophistication and professionalisation of money laundering demands a more advanced and adaptive AML approach. The figures in the CTIF-CFI annual report also necessitate the development of new strategies and the refinement of existing ones in the fight against money laundering and terrorist financing.

Trusted AI solutions are becoming essential assets in building a more effective AML framework. Discai’s AI-driven solutions can support your organisation by:

✓ increasing the relevance of investigations through smart prioritisation and case enrichment;

✓ uncovering money laundering schemes, including complex and hidden patterns;

✓ reducing false positives, enabling your teams to focus on what matters.

Our AI suite includes:

Supervised learning: Amplifies investigative capacity by leveraging insights already embedded in your organization’s data.

Targeted typology detection: Custom models trained to detect specific typologies such as social fraud or fiscal fraud.

Anomaly detection: Identifies atypical behavior at the client level within specific segments.

Discai’s AI platform can help your organisation to outpace financial crime.

Want to discuss an anti-money laundering solution that’s fit for the digital age?

Get in touch